Real Estate Holdings has historically considered the best way to preserve wealth and hedge against stock market fluctuations. Currently, Real Estate Investments present significant inefficiencies and liquidity issues. Equitybase is applying blockchain and smart contract technologies to the world of Real Estate investments and holdings in order to solve these issues. BASE is an Ethereum Smart-Contract ecosystem that focuses on creating a platform for Real Estate investment. By, eliminating varies cost due to unnecessary intermediaries, providing liquidity and transparency in pricing along with easing cross border transactions under a central platform.

Real Estate is the largest asset class in the world and it is also illiquid. Equitybase platform will offer transparent, non-time restrain and liquid solutions to invest and trade real estate properties worldwide on our decentralized system. Tokenized ownership will simplify every aspect of property investment, partial / full ownership transfer and debt purchase / sell.

We are using token crowdsale offering to enhance our platform development and a secondary reserve pool, our platform will be secure and tamperproof smart contract blockchain based system which allows us to purchase, transact and liquidate with our streamline and effective process.

The whitepaper will explain the principles of the Equitybase platform and the economic value of a "BASE" token to its contributors.

Historically, real estate has proven to be one of the best-performing investments. As real estate developers ourselves, we spent our early careers building and owning commercial real estate properties.

Yet, too often the portion of the profits from the projects ends in the pockets of our institutional investment partners, who in reality were acting as a middleman standing between us and the actual people whose money was being invested.

What is Equitybase?

equitybase is a end-to-end commercial real estate ecosystem for project assessment, credit valuation, liquidity event entirely on the blockchain. equitybase allows developers and fund managers to offer asset backed investment opportunities to investors worldwide.

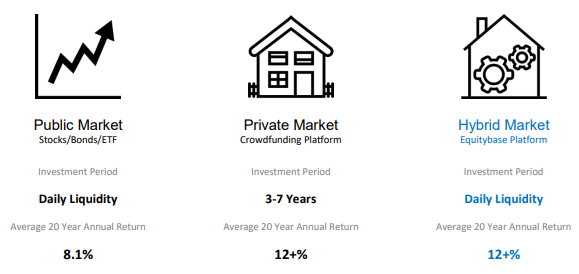

Equitybase has a simple solution: investing in a real estate investment, with the liquidity of a stock and earnings of a private equity investment combined with no lock-in period and no middleman.Equitybase will offer a diversified real estate investment platform available online to anyone online. We make the process of investing in the highest quality commercial real estate from around the world simple, efficient, transparent and fully liquidable.

Problem

Current investment model are ineffective

Liquidity of Private Markets

Equity investments has long lock-in period ranging from 3-10 years

Funding Accessibility

Developers would be available to obtain funding domestically

Cost of Credit

Interest rate would be varies by region and developers equity would be substantial

Barrier of Entry

Commercial investment requires a huge amount to start

Low Return Rate

Stock market over the past 10 years has average of 7% return per year

High Management Fees

Private equity management fees ranging from 2-4% per year

Solution

Equitybase Hybrid Market Investments Platform

Worldwide Access

Developers around the world can promote their projects on our Equity Invest platform and raise sufficient capital with ease

No Minimum Investment

Investors can invest any amount of their choosing without minimum investment restriction

Credit Rating System

Investors can track performances and track record of developers

Liquid Investment

Our Equity Exchange Platform offers the flexibility for investors to liquidate their asset holdings on any investment

Zero Fees Investment

BASE token holder will be able to utilize the platform without incurring any fees while obtaining dividends on Equity Fund

Dividends and Target Return

Commercial Real Estate Investment offers one of the highest returns and dividends on any asset class around the world

Equitybase Platform provides a whole investment ecosystem from dividends, investing, liquidating and exchanging.

Equity Reserve

Equity Reserve will provide an additional layer of liquidity to the Equity Exchange platform, it will be utilized as a reserve pool to continuous enable the user's platform to liquidate their holdings with guaranteed buyback on the exchange.

Equity Invest

Equity Invest allows developers and fund managers to update project status, disburse funds, along direct interaction with investors.

Investors would be able to track earnings, sponsors and project credit ratings, payment history, withdraw dividends and gains.

Equity Exchange

Equity Exchange enable investors to liquidate or buy tokenize real estate holdings on the platform via crypto and fiat currency. Equity Exchange will be able to add intrinsic valve base on the performance and demand of each holdings individually.

Equity Fund

(4th Quarter 2018 ICO, Reg.A + Offering)

Equity Fund target of 7% + annual yield payout from asset operating income on a quarterly basis. Equity Fund growth will come from its capital event or refinance of asset holding which allows its token holder to generate additional yield overtime. Equity Fund will be trading on our Equity Exchange and third party crypto exchange platform with full liquidity.

Equitybase ICO

BASE: EquitybaseERC20 Token

A capped pre-sale of BASE token will start on 02/08/2017 to 02/21/2018 at a discount rate of 40%, BASE token sale will be conducted via smart contract and fully audited by Coinfabrik to ensure the security of the ICO process. The proceeds from the ICO Offer 80% of the funds will be used for acquisition of assets (Equity Fund) and 20% will be for product development and operations.

Public ICO of BASE Token will start on 02/28/2018 and end on 05/22/2018 with initial discount of 30%, discount rate will be lower in increments of 5% weekly over the duration of the ICO sale. We expect BASE Tokens acquired during the ICO process will be substantially discounted against trading values on public exchanges. Minimum contribution during the public ICO will be at 0.001 ETH. Transfer rate is set at $ 0.28 / Per BASE Token.

Equitybase Roadmap

3Q / 2017 Company Formation

equitybase formation

Team formation. First steps in development of architecture of the equitybase platform.

4Q / 2017 Funding Development

Seed Round: $ 300,000

Begin platform development

1Q / 2018 Crowdsale

Private Pre-Sale

Pre-ICO

Public ICO

Demo version of the platform released

front-end and back-end development, API testing

2Q / 2018Dividends Platform Release

Beta Release of Equity Invest platform

Exchange listing of BASE Token

Liquidity aggregation with multiple cryptocurrency exchanges established

3Q / 2018 Development User acquisition

mobile App Launch

Partnership and User Acquisition

Credit Rating and Full Reporting integration

4Q / 2018 Expansion

Establish Region office in London, Shanghai

Expand offerings to hedge funds and private equity funds

Equity Fund ICO

Direct FIAT currency conversion

TEAM AND ADVISOR

Official Source:

Website: https://equitybase.co

White Paper: https://equitybase.co/equitybasewhitepaper1.pdf

Twitter: https://twitter.com/equitybaseco/

Facebook: https://www.facebook.com/equitybase/

Telegram: https://t.me/equitybase

Medium: https://medium.com/equitybase

author: ALEX789

Tidak ada komentar:

Posting Komentar